30/09/20 Winter Economy Plan

Covid winter rescue plan: What you need to know

Chancellor Sunak revealed five measures to help businesses survive into 2021: a job support scheme, more SEISS grants, improved loan terms, further deferrals of tax payments and a continuation of the 5% VAT for the hospitality sector.

Trick or treat came early this year as during “Not the Autumn Budget” Chancellor Rishi Sunak announced five broad areas to help businesses through the winter. The tricks, in the form of tax rises, are likely to be postponed until at least April 2021, but if anything is slipped through as changed regulations, we will let you know.

This is what we know so far about the new and improved business support packages, dubbed the winter economy. Follow the links below for more detailed articles.

The current furlough scheme will end on 31 October, and the job support scheme comes into effect on 1 November, with the same aim of keeping employees working in real jobs for as long as possible.

The job support scheme can apply to any employee who was on the payroll on 23 September 2020, so it is not restricted to employees who were furloughed at some point between March and October.

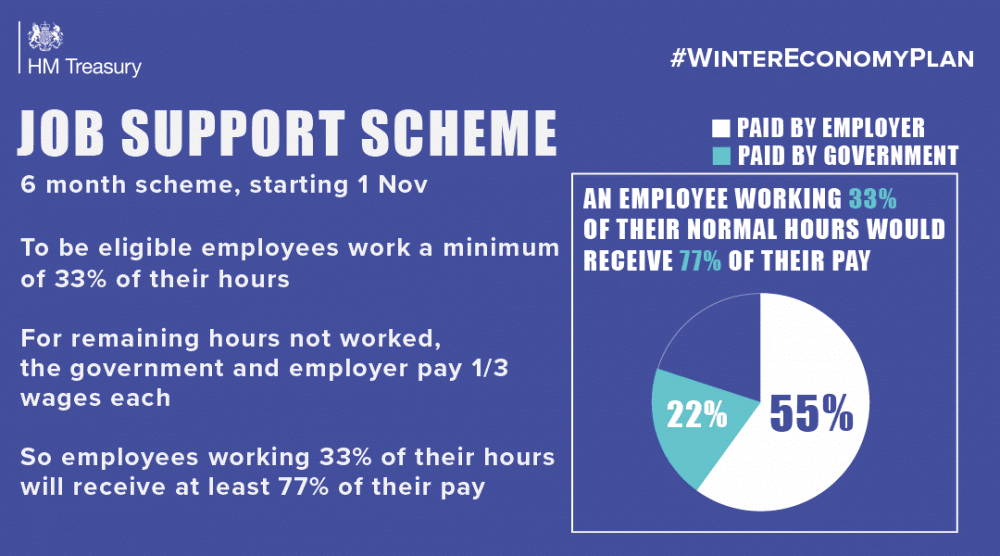

To qualify for job support, the employee must work for at least one-third of their usual hours and the employer must pay for all those hours, presumably at the employees’ usual rate, but this is not clear.

Of the employee’s “resting” hours the Government and employer must each pay one-third of the employee’s usual wage rate, see graphic. It should work out that the employer pays 55% of the employee’s wages for one-third of their normal working time.

The government’s contribution is capped at 22% of usual wages and £697.22 per month

The employer will bear the cost of the employer’s NI and pension contributions on all the employee’s pay.

There will be no restrictions for small and medium-sized businesses who want to use the job support scheme. However, large employers (as yet undefined), will have to show that their business has been adversely affected before they can use the job support scheme. Larger employers will also be banned from paying dividends to shareholders, or using share buy-back schemes, while they are using the job support scheme.

Employers who use the job support scheme will also be able to claim the coronavirus job retention bonus scheme for employees who qualify. Kate Upcraft has more details on how these two schemes interact.

Further SEISS grants

The second SEISS grant, which closes for applications on 19 October was supposed to be the final grant for the self-employed.

But the Chancellor made it clear that a third SEISS grant will be available to cover 20% of average monthly profits for three months, for those who were eligible for the first and second SEISS grants. This will be capped at £1,875 per taxpayer. It is not clear when applications will open or close for this grant.

In addition, a fourth SIESS grant will be made available for the three months to cover February to April 2021.

It is possible that this SEISS grant may be open to self-employed taxpayers who were excluded from the first three SEISS grants as they started their business on or after 6 April 2019. Those taxpayers will have submitted their 2019/20 tax returns by 31 January 2021, so the fourth SEISS grant could be based on average self-employed profits, including those reported for 2019/20.

In summary, the SEISS grants are:

| Grant number | Percentage of average monthly profits | Maximum per month £ | Maximum grant £ | Deadline for applications |

| 1 | 80% | 2,500 | 7,500 | 13 July 2020 |

| 2 | 70% | 2,190 | 6,570 | 19 October 2020 |

| 3 | 20% | 625 | 1,875 | TBA |

| 4 | unknown | unknown | unknown | TBA |

Bounce Back Loan scheme upgraded to Pay As You Grow

All the existing coronavirus loan schemes have been extended. Applications for the small and large versions of the Coronavirus Business Interruption Loan Scheme (CBILS), the Bounce Back Loan Scheme (BBLS) and the Future Fund will be open until 30 November, with 31 December set as the new deadline for approvals.

Both CBILS and BBLS loans will be extended to 10-year repayment terms. The £50,000 BBLS package that has channelled £38bn to 1.2m businesses is being rebranded as “Pay as You Grow” and will offer borrowers more flexible repayment schedules, starting with interest-only repayments for up to six months. Struggling businesses will also be able to request six-month repayment holidays.

Tax deferrals

One of the first coronavirus tax announcements was a deferral of the payment on account (POA) of income tax due on 31 July 2020. This tax payment is delayed to coincide with the final payment for 2019/20 due by 31 January 2021. No interest will be charged on the late paid tax. The deferral was also optional, taxpayers could pay the tax due by 31 July 2020 if they wished.

Now the Chancellor is giving individual taxpayers even longer to pay all of the taxes due by 31 January 2021, which is made up of these amounts:

- Second POA 2019/20

- Balancing payment 2019/20

- Capital gains tax 2019/20 (if not paid under 30-day rule)

- First POA 2020/21

Unlike the deferral in place on 31 July 2020, the taxpayer will have to apply for time to pay to spread the tax due over 12 monthly instalments to January 2022. Where the total tax due doesn’t exceed £30,000 the application for time to pay will be agreed automatically when the taxpayer applies using an online form.

If the tax due exceeds £30,000 or the taxpayer needs longer to pay, the telephone service will still be available to agree a bespoke payment plan.

VAT changes

Alongside the deferral of income tax in July 2020, the VAT payments due in period 20 March to 30 June 2020 were also automatically deferred until 31 March 2021. This deferral would normally represent the payment due for one VAT quarter.

All the businesses who took advantage of that deferral will now be able to spread that deferred VAT payment over 11 equal instalments payable between April 2021 and March 2022. The business will have to apply online for this further deferral.

In addition, the reduced rate of VAT for the hospitality and tourism sector, which was due to revert to 20% on 13 January 2021 will now apply until 31 March 2021.